The key to success is to be thoroughly prepared. Succession will happen within families, but it is not always certain that it will be accomplished strategically. Succession planning for business owners calls for deliberate preparation, and it requires time— typically years or even decades—as well as forethought, commitment, diligence and adaptability.

Transitioning Ownership

The decisions made regarding ownership of the family office or closely-held business may not necessarily be the same decisions that are required for leadership and management. It’s critical to understand and acknowledge the different elements that proper succession planning entails.

The family wealth enterprise has three interconnected circles of participation—the family members, the family’s business and the ownership of wealth—and each circle requires a succession plan. Those plans should reflect the family’s shared values and aspirations, and they should be implemented with business-like focus and diligence that is tailored to each family’s dynamics and relationships.

To successfully transition the family ownership, business and financial wealth to succeeding generations, leaders must be groomed and/or nurtured to assume the mantle of these responsibilities with competence. Moreover, to ensure that the family legacy remains intact and on course, each person assuming a new role must embrace the family’s common vision.

Outlining deliberate plans to accomplish related goals across the family, business and ownership will help achieve an orderly, prosperous succession that protects the family legacy for generations to come.

What is Succession Planning and Why Is It So Important?

Robust governance practices form the cornerstone of success for the family wealth enterprise, and ongoing succession planning for business owners is one element of a mature governance system. As a family considers its future succession, it is vital to understand why a well-conceived plan is so important and what the critical elements of the plan entail. The succession plan prepares heirs to transition successfully and preserve, grow and pass wealth from generation to generation.

Otherwise, the family wealth enterprise can diverge from the family’s values, philosophies and direction, which may erode family unity, endanger the legacy and dissipate financial wealth.

Effective governance protects the five forms of family wealth outlined below, and succession planning is a pivotal aspect of governance:

- Financial capital (money and assets)

- Human capital (the family members themselves and their skills and experience)

- Intellectual capital (knowledge, ideas and perspectives)

- Social capital (professional and social relationships, community involvement and philanthropy)

- Ethical capital (values, philosophies and responsible practices that improve the lives of others)

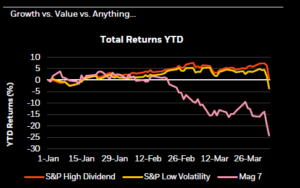

Imagine the succession plan as the roadmap that provides all necessary directions to reach the desired destination. It outlines specific roles and a timeline for training heirs to manage of all five forms of family wealth. Thoughtful succession planning for business owners also gives business stakeholders confidence about continued stability during times of transition and beyond, thereby increasing the family wealth enterprise’s resilience. Challenges will arise—including economic downturns and changes in the workforce and workplace—so it’s important to prepare for the unexpected.

The Elements of Succession Planning

The plan for success must specify ways to prepare heirs to be good stewards of wealth and enable them to understand their evolving roles and responsibilities. The ideal candidates will need to develop their financial literacy and business acumen, as well as leadership and decision-making skills.

Heirs can build financial literacy from a young age by managing their own expenses and then participating in the financial aspects of the family business. Understanding key financial concepts and practices provides a foundation to gain valuable workplace experience and develop business acumen. When heirs understand the finance function and the inner workings of a business, they can think strategically to identify risks and opportunities.

To develop their leadership capabilities, heirs must appreciate the importance of being accountable to others while holding others accountable as well—an especially delicate task when working with family members. Sound leadership requires emotional and social intelligence to communicate effectively, bearing in mind that some family members will receive and process information differently. Strong leadership skills are especially necessary within the business, and these will help heirs thrive in supervisory roles and gain buy-in from stakeholders.

To fill ownership and leadership roles, heirs need to develop their decision-making capabilities as well. They will have to weigh competing interests and make judicious decisions that yield the maximum benefits over the near term and long term. Drawing on leadership skills and business acumen enables heirs to make decisions more effectively. Ultimately, when identifying a successor, it is prudent to empower those who demonstrate a passion for the role and have the necessary skills to make a meaningful contribution.

“Before anything else, preparation is the key to success.” -Alexander Graham Bell

Succession Techniques

Succession planning for business owners should be rooted in an evaluation of the abilities and desires of those family members who are potentially in line for succession. Future family heirs will need education, training and business experience. Some heirs may not be interested in participating directly or may not have skills conducive to the family’s needs in this area. In some cases, extenuating circumstances (e.g., health issues, conflicting commitments, et al.) may also complicate having certain individuals directly involved in the succession plan.

Ultimately, some heirs may have active involvement while others have passive involvement— such as participating on the board but not engaging in day-to-day activities—so thorough planning and preparation are crucial.

Training and education for succession are key components of a sound plan and enable heirs to develop increasing levels of responsibility. These practices also limit overall risk to the family wealth enterprise by entrusting a specific set of duties to an heir, so they can demonstrate full competency before expanding the scope further. One way, for example, of enabling a family member to obtain this education is by completing an internship at the family business and then taking a position at another organization for a period of time prior to rejoining the family’s business in a permanent role.

An important aspect of family office governance is the family committee (also referred to as the family board or council), which comprises of core family members who review and execute key decisions. Within the family committee, heirs can serve as junior members who attend and observe before getting a voting role, so that they understand the process and responsibilities. It’s also helpful for heirs to have a service mentality in line with the family’s common philanthropic goals, and they can build this by participating in the family foundation, if one exists.

Younger family members can benefit from preparation for board positions as well, which includes receiving mentorship and formal board training. There are also benefits to outlining specific requirements for board participation. From a business standpoint, these steps could be comparable to the process for promoting an employee within the company, and heirs should be prepared to demonstrate a similar level of competence and accountability.

Critical Considerations for Ownership Transitions

Across all three circles of participation in the family wealth enterprise, there are four critical considerations to weigh carefully when transitioning ownership: communicating effectively, ensuring the proper fit, remaining flexible and establishing a new role for senior generations.

Overall, transparency regarding the plan and process helps to increase preparation and avoid conflict. Where necessary, communication can still be restricted on a need-to-know basis. From a timing perspective, different groups of stakeholders will need to be informed about relevant information depending on how aspects of the succession plan affect that group. These stakeholder groups may include family members, direct succession contenders and extend to key employees, crucial third-party professionals and the general public. The communication strategy must account for the perceptions and reactions that could result. Effective communication and planning can minimize the potential for confusion or resentment. Especially within the family, soliciting input and acknowledging everyone’s viewpoints will help build consensus and prevent simmering discontent.

Ultimately, the most important factor is to select a successor who fits well in the role. While there is no definitive list of characteristics that describe an ideal successor, it’s best to have a combination of relevant experience, business acumen and emotional intelligence. These qualities help a successor address an array of challenges and build trust with key stakeholders.

The ideal leadership traits must be rooted in the family’s shared values, and they can include:

- Humility: Know what you don’t know and be willing to listen and learn.

- Accountability: Take responsibility for your decisions and hold others accountable.

- Maturity: Regardless of age, exercise good judgment and act in the best interests of the family and business.

- Integrity: Act in accordance with the family values, especially for difficult decisions.

- Diligence: Work hard, be engaged and lead by example.

- Cohesion: Be a good teammate, encourage collaboration and foster a shared culture.

As with any plan, flexibility is an important consideration. Remaining responsive to shifting circumstances or unexpected changes should be worked into the overall plan for succession. For example, the person chosen as a successor may not be able to fill the role as expected for a range of reasons, such as an unforeseen change in personal obligations or health status.

Scenario planning is an important aspect of preparing for a range of contingencies and responding accordingly.

Another critical aspect of planning is mapping out the new role for members of the older generation. They have significant knowledge to impart and are accustomed to holding influential positions, so a natural fit for them could be a board chair or head of the foundation, or both, if applicable. Correlated concerns include identifying any challenges and mitigating fear or resentment, which can come from internal conflict or frustration over a loss of control after decades of leadership. An outside facilitator who specializes in family dynamics can help identify and navigate these concerns in a constructive manner to ease the transition. It’s best to address such conflicts as soon as possible to avoid intervention after the transition.

Involuntary Succession: Preparing for the Unexpected

Unfortunately, some successions are not voluntary. Because there are many different considerations to weigh and significant planning required for a voluntary succession, the process can stall or hit a roadblock. This exposes the organization to greater risk, so it behooves all key stakeholders to make adequate preparations and guard against an involuntary succession, which could be caused by death, disability, the unanticipated sale of the business or other unexpected factors. Thorough preparation and scenario planning help alleviate the effects of an involuntary succession and maintain resilience during unforeseen occurrences.

The Path to Success

Succession will happen, so it’s important to plan accordingly— and well in advance—to achieve the desired outcome and maintain the family wealth enterprise. The plan should outline specific measures to educate heirs and have them gain experience with finances, leadership and decision making. Each type of succession across the family, business and ownership circles also needs to have its own distinct plan to ensure success, in combination with assessing the right fit for the role and communicating about this effectively.

Adaptability is a key aspect of succession planning for business owners, allowing the organization to adjust to unexpected occurrences without significant disruption. Ensuring members of the older generation have a new role to transition into, so that they can impart the value of their wisdom and experience can help to enable a smooth transition. Taking this proactive approach to succession planning positions the family, ownership and business for continued success, which will safeguard the family legacy for generations to come.

Succession Planning in 5 Steps

- Determine how heirs will get education and experience with finances, leadership and decision making.

- Assess and decide the best fit for the role.

- Make a distinct succession plan for the family, business and ownership circles of participation.

- Communicate the succession plan to all key stakeholders.

- Establish a new role for members of the older generation.

Learn more about how Wiss’ Family Office Services help families preserve, protect, and pass on wealth.