An accurate commercial real estate valuation is the backbone of informed decision-making in the property market. Whether you’re buying, selling, or investing, understanding the true value of a property ensures fair transactions and prevents financial pitfalls. But how are these valuations determined, and why are they critical in today’s dynamic market?

This blog explores the key factors influencing property valuations, the role of technology in enhancing accuracy, and practical tips for buyers and sellers to secure fair valuations.

Why Accurate Property Valuations Matter

Real estate valuations influence far more than just the buying and selling price of a property. They affect financing options, taxation, and long-term investment returns. Here’s why precision matters:

- Buyer Confidence: Accurate valuations help buyers avoid overpaying, ensuring they invest in properties that match their worth.

- Fair Selling Prices: Sellers benefit from realistic pricing, preventing undervaluation and ensuring they gain the full value of their asset.

- Financing Clarity: Lenders rely on property valuations to determine mortgage amounts, ensuring financial risks are minimized.

- Market Transparency: Well-established valuations contribute to stable market dynamics by aligning expectations between parties.

When property valuations are inaccurate, the result is often disputes, missed opportunities, or improper financial decisions.

Key Factors That Influence Property Valuations

Determining a property’s value involves more than a surface-level assessment. These key factors are at the heart of every valuation process:

Location

Location is a primary driver of property value. Proximity to schools, public transportation, parks, and commercial areas can significantly raise a property’s appeal.

For example:

- Properties in urban areas or growing suburbs with access to amenities generally see higher valuations.

- Conversely, properties in less accessible or high-crime areas may experience lower valuations.

Market Trends

The broader real estate market heavily influences property values. Assessment factors include:

- Supply and Demand: Limited inventory can push prices up, while an oversupply may lead to depreciation.

- Economic Conditions: A thriving economy typically boosts valuations due to increased buyer confidence.

- Neighborhood Development: Urban development projects, such as new infrastructure or businesses, can enhance a property’s value.

Property Condition

A property’s physical state, design, and functionality directly affect its valuation. Considerations include:

- Age of the Property: Newer properties with modern designs often fetch higher valuations.

- Upgrades and Renovations: Well-maintained homes or those with updated kitchens, bathrooms, and energy-efficient systems often command premium prices.

- Structural Integrity: Any signs of foundational issues or deferred maintenance (e.g., leaking roofs) lower valuations substantially.

Comparable Properties

Valuers also use “comps” (comparable properties) to gauge the price of a property against similar ones recently sold in the area. Differences in size, condition, or upgrades are factored into a comparative analysis to derive a fair market price.

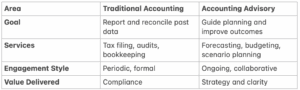

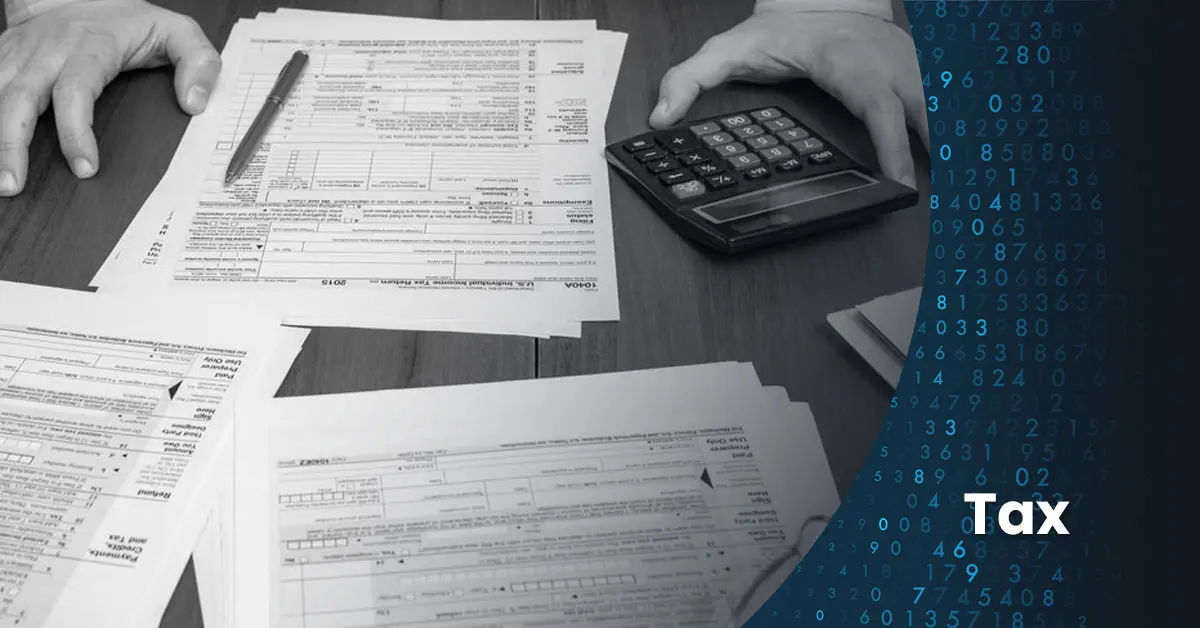

Technology, Tax Implications, and Trusted Sources in Modern Valuations

As the real estate industry evolves, technology and regulatory changes continue to shape how valuations are performed. In this environment, it’s more important than ever to work with sources you can trust. Here’s how to navigate this landscape with confidence:

Trusted Industry Sources

When it comes to a commercial real estate valuation, relying on trusted sources is essential. Working with professionals and organizations known for their expertise, transparent methodologies, and ethical standards can provide you with confidence in your results. Utilizing credible sources helps ensure your valuation is accurate, objective, and well-supported. This approach offers peace of mind whether you are reviewing, commissioning, or acting on a property valuation.

Tax Implications and Regulatory Changes

Property valuations aren’t just about sales or investments; they’re also a crucial part of your tax planning strategy. Changes in federal or state tax laws, such as adjustments to estate tax exemptions or new regulations on property transfers, can significantly alter your need for an up-to-date valuation. For instance:

- If the estate tax exemption sunsets or decreases, having a precise, defensible valuation becomes even more important for succession planning and wealth transfer.

- New laws may affect how gains are calculated for capital gains taxes when selling or transferring real estate.

- Regular valuations can ensure you’re not caught off guard if tax regulations shift suddenly.

Staying informed and consulting reputable sources, such as those previously mentioned, will help you adapt to these changing tax landscapes and make more strategic decisions.

Tips for Buyers and Sellers to Ensure Fair Valuations

For both buyers and sellers, understanding the factors at play and conducting thorough due diligence is critical to ensuring fair property valuations. Here are some practical tips:

For Buyers

- Research the Market: Examine comparable properties in the same area to confirm the asking price aligns with market conditions.

- Hire an Independent Appraiser: Don’t solely rely on the seller’s valuation. Hiring a third-party appraiser adds an extra layer of confidence.

- Evaluate the Long-Term Potential: Look at factors such as neighborhood development plans or infrastructure projects to assess future value growth.

For Sellers

- Invest in Repairs: Fixing structural issues or making cosmetic upgrades could yield higher appraisals and increase buyer interest.

- Stay Realistic About Pricing: Overpricing may deter buyers, while underpricing risks underselling your asset. Leverage expert advice to find a realistic starting point.

- Work with Professionals: Collaborate with experienced real estate agents and appraisers to back your listing with credible pricing information.

For Both Buyers and Sellers

- Understand the Valuation Report: Whether buying or selling, ensure you’re familiar with how the property was valued. Don’t hesitate to ask questions or request clarifications.

- Be Wary of Red Flags: If a property’s valuation feels suspiciously high or low, dig deeper to determine underlying reasons. Sudden price changes might indicate market abnormalities or hidden defects.

Ensuring Confidence with an Accurate Commercial Real Estate Valuation

Accurate real estate valuations are crucial in navigating one of the most significant financial decisions people face. With an understanding of the factors that influence property values, as well as the benefits of leveraging technology for accuracy, buyers and sellers alike can approach the process with greater confidence. By investing in expert guidance, conducting thorough research, and staying informed about market trends, you can ensure fair and transparent property transactions throughout the entire process.

If you’re seeking professional support for your next commercial real estate valuation or would like to stay informed about the latest industry trends, please don’t hesitate to contact our team. We’re here to help you make informed, confident decisions about your real estate investments.