Choosing between in-house vs. outsourced accounting for SaaS companies is one of the most important calls a founder or CFO will make. From subscription revenue to ASC 606 compliance and investor reporting, the stakes are high. The right model supports growth, accuracy, and fundraising. The wrong one creates costly delays.

In this article, we’ll compare both paths so you can decide what fits your current stage and long-term vision.

What Makes SaaS Accounting Unique?

SaaS accounting isn’t like traditional bookkeeping. The business model runs on recurring revenue, which brings unique financial challenges. These include:

- Subscription billing cycles

- Deferred revenue tracking

- Multi-year contracts and renewals

- ASC 606 compliance

If these aren’t managed correctly, reporting can quickly become inaccurate or non-compliant.

SaaS companies also depend on key metrics to make decisions:

- MRR (Monthly Recurring Revenue)

- CAC (Customer Acquisition Cost)

- CLTV (Customer Lifetime Value)

- Churn rate

- Cash runway

Accurate forecasting and metric tracking aren’t optional. They’re how SaaS founders raise capital, plan headcount, and forecast growth. Traditional accounting systems often fall short.

Option 1: In-House Accounting Teams

Hiring an internal finance team can seem like the natural next step. There are some clear advantages:

Pros:

- Direct control over people and processes

- Team alignment with internal operations

- Full-time access to data and reports

But for many SaaS startups, the drawbacks are hard to ignore.

Cons:

- High cost of salaries, benefits, and recruitment

- Limited experience with SaaS-specific needs like ASC 606 or revenue forecasting

- Slow to adapt to change or growth

In-house finance is often a better fit for mature companies with $20M+ ARR. For earlier-stage teams, the cost of outsourced accounting usually brings more value more quickly.

Option 2: Outsourced Accounting for SaaS Companies

Outsourced accounting for SaaS companies is a scalable service model. It gives startups and growth-stage businesses access to an experienced finance team without building one internally.

What’s typically included:

- Day-to-day bookkeeping

- Accurate financial reporting

- Budgeting and forecasting

- KPI dashboards and MRR tracking

- ASC 606 compliance

- Optional fractional CFO for SaaS

This model is designed for fast-moving SaaS businesses that need to focus on growth, not spreadsheets.

Key Benefits:

- SaaS-specific expertise from day one

- Faster setup with pre-built systems

- No hiring, training, or long-term contracts

- Scalable based on your growth

- Ideal for venture-backed or lean startup environments

Wiss helps SaaS companies streamline operations using smart tools through our Technology & Automation solutions. For strategic guidance, our CFO Advisory Services provide growth forecasting, board prep, and capital raise support, without needing a full-time hire.

This creates a scalable finance solution for startups that want to stay lean and focused.

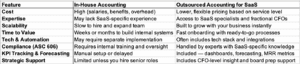

Side-by-Side Comparison Table

How to Choose the Right Fit for Your SaaS Business

The right approach depends on your stage of growth and the complexity of your operations.

When In-House Might Make Sense

- Later-stage SaaS companies with $20M+ ARR

- Businesses with complex internal operations or multiple international entities

- Teams that want direct, full-time control of finance functions

When Outsourcing Is Ideal

- Early to growth-stage SaaS companies that need fast, accurate reporting

- Lean teams without the budget for full-time finance staff

- Venture-backed startups that must provide investor-ready reports quickly

A Hybrid Path

Many SaaS founders start with outsourced accounting to gain speed, expertise, and compliance. As they scale, they may evolve into a hybrid or in-house model while continuing to leverage external CFO advisory.

Not sure which is right for you? Consult with the Wiss team to design a finance strategy that matches your growth goals.

Final Verdict: In-House or Outsourced Accounting for SaaS Companies?

Both models have their place. In-house accounting can work for large SaaS organizations with complex operations and the resources to hire full teams. But for most scaling SaaS companies, outsourced accounting for SaaS companies delivers more value. It offers lower cost, faster setup, SaaS-specific expertise, and the ability to scale with growth.

Reach out to Wiss to explore scalable accounting solutions designed for SaaS growth.

Frequently Asked Questions about Outsourced Accounting for SaaS Companies

1. How fast can outsourced accounting be set up for a SaaS company?

Most outsourced providers can onboard within weeks, using ready-made processes and tools designed for SaaS metrics and reporting.

2. Will investors trust financials from an outsourced team?

Yes. In fact, investors often prefer outsourced accounting partners because they deliver standardized reports, ASC 606 compliance, and reliable forecasting.

3. Can outsourced accounting grow with my SaaS business?

Absolutely. Services can start small with bookkeeping and reporting, then expand to include forecasting, compliance, and CFO-level strategy as the business scales.

4. Do I lose control if I outsource accounting?

No. You still own the data and have access to dashboards and reports. Outsourcing simply provides expert execution and strategic guidance.

5. How does outsourced accounting handle SaaS automation tools?

Top providers integrate with SaaS-friendly platforms like Rillet, Stripe, QuickBooks, NetSuite, or custom dashboards to ensure accurate, real-time reporting.

Previous

Previous