By Chirag Sharma & Jack Hounsell

Key Takeaways

- Rising real yields and progress on core disinflation have vastly improved the risk/reward of investing in fixed income and increased the odds that the Fed is done hiking

- Strong corporate profits this year might be a tough act to follow in 2024 as companies face multiple headwinds to growth, namely declining pricing power and rising interest costs

- The consumer remains a vital component of economic prosperity and has proven extraordinarily resilient through this hiking cycle, but that fortitude will likely be tested in the coming quarters

Fed & Inflation

Fed remains unchanged again

In a unanimous decision on November 1st, the Federal Reserve (Fed) left interest rates unchanged at a range of 5.25% and 5.50%. This marks the second straight meeting in which a rate hike was skipped. However, Fed Chair Jerome Powell did not rule out future increases. Markets reacted positively to the news as stock prices rallied and bond yields fell.

The Fed’s November statement maintained the possibility of future rate hikes as they remain “highly attentive to inflation risks”. The Committee is still determining the lagged effects of the current monetary policy, as Powell stated, “the full effects of our tightening have yet to be felt”.

The Fed believes both the financial and credit conditions will likely weigh on overall economic activity for households and businesses. As mortgage rates recently reached 8%, and the average credit card sits at over 20%, high borrowing costs are omnipresent for consumers and businesses alike. Despite this, Powell did make a surprisingly positive statement on wage growth during the post-meeting press conference. Citing wage data, Powell noted that “wage increases have really come down significantly over the course of the last 18 months to…where they’re substantially closer to that level that would be consistent with 2% inflation over time”.

If we look back at the start of the rate hiking campaign over 18 months ago, the predominant concern was targeting an appropriate interest rate level to prevent inflation from becoming entrenched. As we stand today, that predominant concern has become more balanced with the competing concern of if the Fed is doing “too much”. The Fed is proceeding carefully, with the risk of higher interest rates becoming more two sided. As inflation continues to moderate, albeit still not at its long-term target, the Fed now has the luxury of more heavily considering the economic growth outlook, as witnessed by a second straight pause.

Treasury inflation protected securities (TIPS) are pricing in inflation of 2.5%, implying that expectations are well anchored, and for the first time in over a decade, “real yields” are meaningfully positive. There’s also a case for significant gains with far less downside risk. According to “bond math”, 30-year treasuries would gain nearly 13% over 12 months with a half point drop in yields, but they would lose less than 3% if rates rose by half a point. This rapid rise in real and nominal yields has led to the Fed holding steady until they see how financial conditions react.

Earnings

Market Earnings & Corporate Profits

At the start of the year, investors and economists were confident that 2023 would be a challenging year for the economy, markets, and corporate profits, but growth has been better than expected and earnings results have been strong for the most part. So far in Q3 2023, 71% of companies have beaten earnings estimates. It may be difficult for these strong earnings to persist in 2024, however, as multiple headwinds to growth exist, most notably a weakening consumer, tightening financial conditions, and slower business spending. Management commentary has been relatively downbeat so far, indicating a potentially more challenging business environment ahead than earnings would suggest.

The 2024 outlook stems from declining pricing power and rising interest costs. As inflation increased, companies were able to pass along cost increases to consumers who proved to be very resilient. As excess savings decline and consumer credit rises, this resiliency will be tested, and companies’ ability to increase prices is in question. This pricing dynamic represents probably the biggest headwind to corporate profits, but rising interest costs should also weigh on margins. Academic research suggests that companies are squeezed for cash 6-9 months after the Federal Reserve’s last rate hike. A decade of near-zero rates should soften this cash squeeze as companies had ample time to lock in favorable interest rates, but it is still expected to weigh on profits at least some.

It is important to note that S&P 500 earnings are not the same as economy-wide measures of corporate profits. The S&P 500 is more concentrated in manufacturing and the information industries. The economy, on the other hand, is more balanced and has greater exposure to the financial industry, as well as professional, administrative, educational, accommodation, and health care services. Given this more diverse composition, broad measures of corporate profits exhibit less volatility than the S&P 500 but are more susceptible to weakness in smaller businesses. This further highlights the fact that the stock market and broad economy do not always paint the same picture.

Consumer

Spending Growing Faster Than Income

The U.S. consumer plays a pivotal role in driving the economy serving as a stabilizing force during uncertain times. When the consumer stumbles, it can lead to economic downturns. Over the past two years, the consumer has contended with a host of headwinds that could impact spending habits. Despite these challenges, consumers have shown remarkable resilience. For 75 years, the consumer has amassed an ever-growing importance in our expanding economy. Today, consumption accounts for 69% of Gross Domestic Product (“GDP”), while private investments, net exports, and government spending account for the remaining 31%.

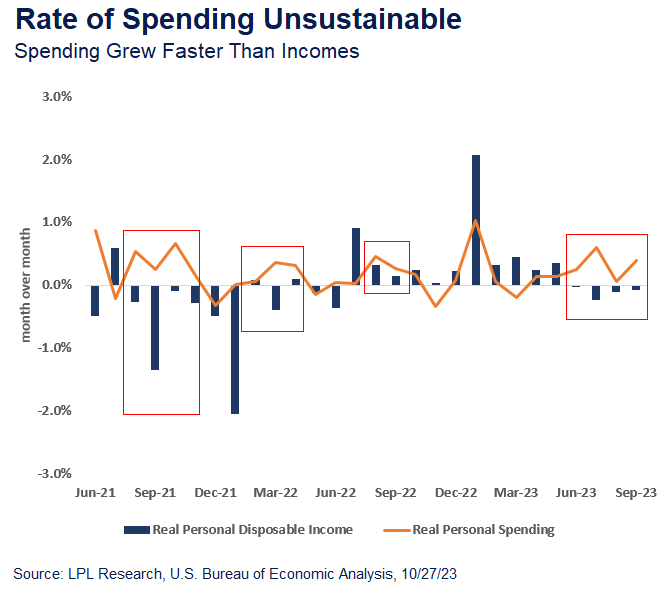

In the most recent GDP report, the U.S. economy grew at a 4.9% annualized rate in Q3, a sharp acceleration from the previous quarter of 2.1%. While this economic resilience is welcomed, it may be difficult to maintain. For several months now, spending grew faster than disposable income which is clearly not sustainable in the long run. As shown in the below chart, investors have seen a few recent periods when real monthly spending grew faster than real income. In each of these periods, savings levels were higher and credit levels were lower, so there was not as much concern about whether the consumer would falter. However, credit levels are rising, and pandemic era savings have dwindled. As a result, the dynamic between income and spending is becoming more important to watch.

On the flip side, there are some bright spots for the consumer. In May 2023, nominal wage growth exceeded inflation, meaning real wage growth turned positive. All else equal, this is a tailwind for the consumer. The labor market has also remained strong with jobless claims remaining low and job openings remaining high. At the end of the day, the consumer remains strong for now, but as liquidity continues to be pressured, so too could consumer spending habits of many Americans. The broader economic implications are being closely monitored and will become more evident in the coming months as more data is released.

Please reach out to our Family Office Team with any additional questions.