Integrated Tax and Wealth Insights to help you pursue your wealth planning goals

By Chirag Sharma & Jack Hounsell

Key Takeaways

- Prompted by encouraging economic and inflation data, the Fed signaled three rate cuts in 2024 at its December meeting, sparking a late-year fixed income rally

- If history is any guide, the upcoming election and strong returns last year could lead to another positive year for stocks, but a recession could change things

- We detail the key provisions of the SECURE Act 2.0 set to take effect this year that could impact your retirement

The Fed and Inflation

Fed Turns Dovish

The Fed left interest rates unchanged at their most recent Federal Open Market Committee (FOMC) meeting in December. The continued pause was highly anticipated and a further indication that we are indeed at this cycle’s peak policy rates. What came as more of a surprise to market participants was the dovish bias present in both Jerome Powell’s press conference and the updated Summary of Economic Projections (SEP). The SEP dot plot suggests the median FOMC member forecasts three rate cuts in 2024, compared to just one cut forecasted back in September. Markets reacted aggressively to this shift, with futures markets quickly pricing in six rate cuts by the end of 2024.

Persistently strong economic data and an improving inflation landscape set the stage for the Fed’s dovish pivot. Core CPI (inflation excluding food and energy) met expectations in November with a 4.0% year-over-year increase, while the Fed’s preferred inflation measure, Core PCE, came in at a cycle low 3.5%. In addition to this progress on the inflation front, Q3 GDP grew at 4.9%, and the unemployment rate fell to 3.7% in November. Put it all together, and the Fed felt confident not just pausing rate hikes but signaling cuts next year with the most dovish and direct language we’ve seen this cycle.

Market Outlook

What’s Next for Equities?

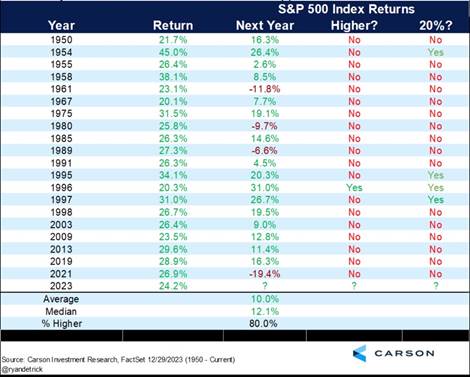

If history is a guide, what type of returns should we expect from stocks in 2024? Large gains like we saw last year, with the S&P 500 up 26.3%, typically bode well for the following year.Since 1950, there have been 20 instances that the S&P 500 has risen 20% or more in a calendar year, and the index has continued higher the following year 80% of the time. However, of those 20 times, only once did stocks actually gain more than the previous year. By this pattern, a modest gain would be expected in 2024.

Perhaps strengthening the bull case is that 2024 is an election year, and more specifically, a re-election year. Dating back to 1952, the S&P 500 has risen an average of 12.2% in election years with an incumbent candidate. This positive performance could be a result of the incumbent party’s strong incentive to avoid a recession leading into the election. Presidents who have successfully avoided a recession within two years of their re-election have gone on to win every time, and vice versa. While a soft landing is now in sight, plenty of recession risks remain, and the outcomes of both the election and the stock market could depend heavily on the direction the economy takes this year.

Retirement

SECURE Act 2.0: 2024 Changes

The SECURE Act (Setting Every Community Up for Retirement Enhancement) was originally passed in 2019, and subsequently updated in late 2022. Some of the changes took effect at the beginning of 2023, while others are spread out over several years. Below, we outline a few of the key provisions that begin this year that are most likely to impact our clients.

Roth Distributions:

Beginning this year, Roth 401(k) and Roth 403(b) plans will no longer require minimum distributions. This change brings those plan types in line with Roth IRAs, which already did not require minimum withdrawals.

529 Rollovers:

Eligible 529 Plan account owners will be able to roll over unused funds to Roth IRA accounts starting this year. Among the stipulations of this change, these rollovers are subject to a $35,000 lifetime limit per beneficiary and the 529 account must be held for a minimum of 15 years before it is eligible to be rolled over.

Student Loan Employer Match:

As of this year, employers are allowed to make matching contributions to employee retirement plans based on the employee’s qualified student loan payments. This will allow individuals to simultaneously save for retirement while also paying down student loan debt.

Wiss Senior Associate Robin Barrasso wrote about the SECURE Act 2.0 last month for the Wiss blog. You can read her blog post here for more details on these and other changes.

Please reach out to our Family Office Team with any additional questions.