By: Wiss Wealth Management Team

Key Takeaways

- We detail what tax-loss harvesting is and why we implement it in client portfolios

- The Fed held interest rates steady at its latest meeting as it awaits more definitive signs that inflation is moving sustainably towards 2%

Tax-Loss Harvesting: How it Works

Tax-loss harvesting is a term you may hear frequently here at Wiss Family Office as tax-efficiency is paramount to us when constructing investment portfolios for our clients. Today, we will provide a brief overview of what it is and why we do it.

Tax-loss harvesting is selling securities at a loss to offset realized capital gains either now or in the future, thereby deferring the tax bill owed on those gains. After harvesting tax losses, we immediately reinvest the proceeds into a similar asset to maintain the target asset mix and risk characteristics of the client’s portfolio. Note: tax code prohibits investors from realizing a loss and purchasing the same security within 30 days before or after the sale (something called a wash sale), so it is for that reason that we place the proceeds into a similar but not identical asset.

Tax-loss harvesting can be implemented on all sorts of investments including stocks, bonds, ETFs, and mutual funds. Direct indexing (replicating a stock index by holding the underlying securities) provides us with many opportunities for tax-loss harvesting throughout the year, making it particularly attractive for the strategy. Even in the very best of years for the broad stock market, there are still lots of opportunities for loss harvesting among the underlying constituents. As you can see in the chart below, every year most stocks experience some level of negative return throughout the year.

Source: Goldman Sachs

Let’s say you have a $5,000 realized capital gain in your account from stock sales earlier this year. Assuming a long-term capital gains tax rate, you may be on the hook for a 20% tax bill, or $1,000. Now, let’s say you also have a position in Coca-Cola stock that is sitting on a $5,000 unrealized loss. You decide to sell Coca-Cola to realize those losses and immediately purchase Pepsi with the proceeds. Your market exposure remains very similar, but you now have $5,000 of realized losses which can be used to offset the $5,000 gain from earlier this year. After netting your realized gains and losses, your account now has zero realized capital gains for the year, reducing what would have been a $1,000 tax bill to $0.

The reason this is so beneficial is that you can now keep that $1,000 invested that otherwise would have gone towards taxes. In the same way that a retirement account allows you to defer paying taxes until retirement, tax-loss harvesting in a taxable account enables you to push some of your realized capital gains into the future, allowing more of your money to compound for you today. This benefit above and beyond a hypothetical portfolio where no tax-loss harvesting takes place can be thought of as ‘tax alpha’.

So, the next time you hear a Wiss Family Office team member talking about all the great losses we were able to realize for clients (phrasing that can admittedly be a bit confusing), you’ll know why we’re talking about that like it’s a good thing!

The Latest on the Fed and Inflation

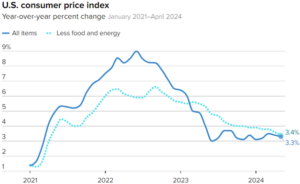

The latest inflation report provided some positive news as both headline and core CPI came in below consensus expectations for May. Headline CPI was flat month-over-month, driven by declining energy prices, while core CPI rose 0.2%. This 0.2% month-over-month increase is much closer to the Fed’s annualized target of 2% inflation than we’ve seen in recent months. This progress is certainly welcomed, but the Fed is likely going to need to see more before feeling comfortable commencing with rate cuts. Since reaching a low of 3.0% in June 2023, headline inflation has bounced between 3.1% and 3.7% for the last 11 months. At their June meeting this past Wednesday, the Fed opted to hold rates steady for a 7th consecutive meeting. Jerome Powell did acknowledge, however, that confidence is building that they’ll be able to begin loosening policy soon, but they’re not there yet.

Source: CNBC, U.S. Bureau of Labor Statistics. Data as of June 12, 2024

After this past week’s inflation report and Fed meeting, the market is still predicting two interest rate cuts in the back half of 2024 as the most likely path for the Fed. This diverges slightly from the Fed’s most recent Summary of Economic Projections which shows the median Committee member now expecting just one rate cut this year. Either way, this represents a huge repricing from the beginning of the year when market participants were pricing in six rate cuts. This repricing of interest rate expectations has been a headwind for bonds throughout the first half of the year, but the market is now relatively in line with Fed guidance. As we head into the back half of the year, market participants will be looking for sustained momentum on the inflation front to indicate when the Fed may begin loosening policy. The next big datapoint on the Fed’s radar is their preferred inflation metric, the PCE Price Index, set to be released June 28th.

Previous

Previous