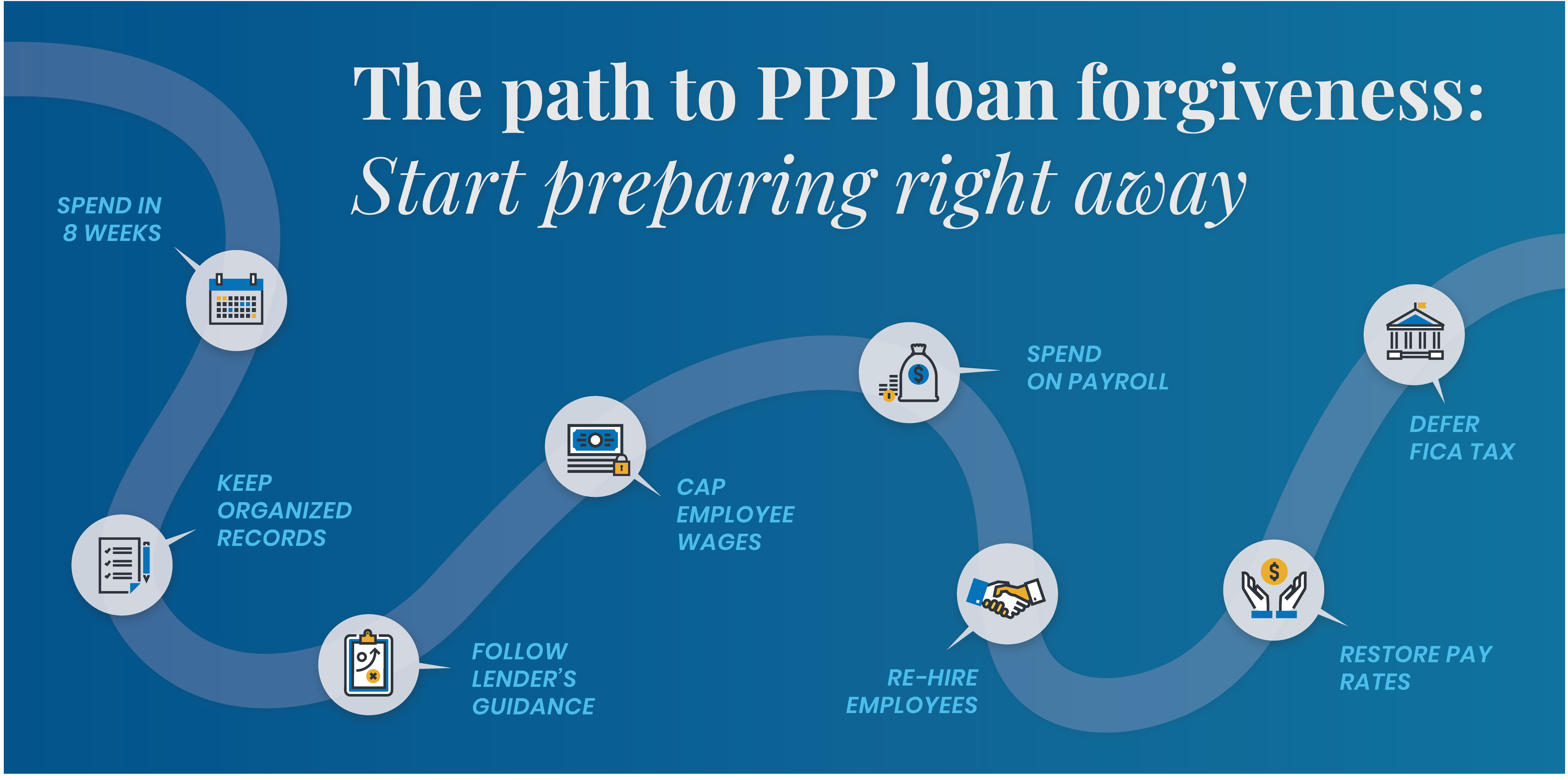

Paycheck Protection Program (PPP) loans are designed to be forgiven, but it doesn’t happen automatically. It’s best to get a plan in place to work toward maximum forgiveness as soon as you receive your PPP loan.

The SBA is expected to issue additional guidance regarding PPP loans; seek out the latest before seeking forgiveness.

Spend your money in 8 weeks

Spend your money in 8 weeks

You have eight weeks from your loan’s funding date to spend the money on qualifying expenses.

Be mindful of payroll processing and payment dates, rent and utility due dates, and mortgage or indebtedness payments during the eight-week window. Any payments not made in that timeframe cannot be included in the forgiveness application.

Keep organized records

Keep organized records

Setting up a clear audit trail is critical to support your application for loan forgiveness.

Since you will request forgiveness through your lender, you will need to provide supporting records for the amount you are requesting. Assume the lender will require a detailed accounting and supporting documentation of how you spent the PPP loan.

Follow your lender’s guidance

Follow your lender’s guidance

It’s vital to do exactly what your lender requests and communicate with your relationship manager.

While SBA oversees and administers the PPP, your lender is the one reviewing your forgiveness application. How banks interpret SBA rules will dictate their procedures and process for approving forgiveness. Know what your lender requires, provide it in detail, and communicate with your relationship manager throughout the process. Once you submit your forgiveness application, the lender is required to provide you with a decision within 60 days of receiving your application.

Adhere to the employee wage cap

Adhere to the employee wage cap

The program requires you to limit each employee’s pay to $15,385 over eight weeks.

The amount of compensation expenses eligible for forgiveness is limited to $100,000 per employee on an annualized basis. This equates to $15,385 of wages during the eight-week forgiveness window ($100,000 *(8weeks/52weeks)). Don’t pay any employee more than that if you want all your wage payouts forgiven.

Ensure 75% loan spending on payroll

Ensure 75% loan spending on payroll

You’ll need to limit non-payroll spending to a maximum of 25% to get full forgiveness.

This program is called “Paycheck Protection” for a reason. If you want loan forgiveness, spend no more than 25% of the loan on non-payroll costs such as rent, interest on debt, and utilities. Any non-payroll expenditures above 25% will not qualify for forgiveness. You can calculate your maximum forgivable amount by multiplying your payroll costs by 0.75.

Re-hire employees to get full forgiveness

Re-hire employees to get full forgiveness

Forgiveness amounts drop for borrowers who do not restore employees by June 30.

Any borrowers who made workforce reductions after February 15 will be penalized in terms of loan forgiveness unless they rehire those employees by June 30. For example, if you had 30 full-time employees or full time equivalents (FTEs) prior to the pandemic, but during the forgiveness window you had 15 and you did not rehire 15 by June 30, only half of your loan will qualify for forgiveness.

Restore pay rates

Restore pay rates

By June 30, you must restore employee salaries that you cut by more than 25%.

If during the payout period you reduced the pay of any individual employee by more than 25% (compared to first quarter of 2020), you must restore their pay by June 30 or some of your loan will not qualify for forgiveness. This penalty provision only applies to employees who earned $100,000 or less on an annualized basis during 2019.

Take advantage of IRS relief

Take advantage of IRS relief

You may defer paying 2020 employer FICA tax until you receive PPP loan forgiveness.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, which includes the PPP, allows a business to defer paying its 2020 employer FICA tax until receiving forgiveness of its PPP loan. (FICA tax is 6.2% on the first $137,700 of an employee’s earnings.) The amount deferred will be due in two installments: 50% on December 31, 2021, and the balance on December 31, 2022. Once you receive PPP loan forgiveness you are no longer eligible to continue deferring the FICA tax.

This is a developing story and information contained in this article is subject to change. We will continue to provide updates as new information becomes available.

Spend your money in 8 weeks

Spend your money in 8 weeks Keep organized records

Keep organized records Follow your lender’s guidance

Follow your lender’s guidance Adhere to the employee wage cap

Adhere to the employee wage cap Ensure 75% loan spending on payroll

Ensure 75% loan spending on payroll Re-hire employees to get full forgiveness

Re-hire employees to get full forgiveness Restore pay rates

Restore pay rates Take advantage of IRS relief

Take advantage of IRS relief Previous

Previous