Accounting today goes far beyond crunching numbers. Business leaders are no longer looking just for someone to reconcile accounts. They want actionable insights, strategic planning, and support in making sound financial decisions. That’s where advisory in accounting steps in.

This form of service focuses on helping companies plan, strategize, and act based on financial information. It’s a shift from reacting to past numbers to using those numbers to influence what comes next.

So, what is advisory in accounting, and how is it different from what your accountant may have been doing all along? This article breaks it down clearly and practically.

What Is Advisory in Accounting?

Advisory in Accounting refers to a set of services where accountants apply their expertise to help clients make informed decisions. Rather than just reporting on what already happened, advisory professionals offer guidance on what to do next.

They work closely with company leaders to understand their goals, then deliver recommendations based on a mix of financial analytics, strategic knowledge, and industry best practices.

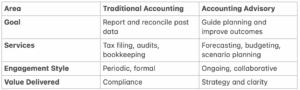

How Advisory Accounting Differs from Traditional Accounting

Traditional accounting tells the story of where a business has been. Advisory services focus on where it’s going.

The advisory accounting definition highlights its role in helping leadership teams stay agile. It’s about equipping them to respond to market shifts, assess opportunities, and make better financial calls.

Types of Advisory Accounting Services

1. Outsourced Accounting Support

This combines bookkeeping with strategic guidance. Instead of hiring in-house staff, companies can work with Wiss to manage financials while receiving expert advice on growth, operations, and performance.

2. CFO Advisory

This service gives businesses access to senior financial leadership without the cost of a full-time CFO. From budgeting and capital planning to investor reporting, it’s a flexible way to get big-picture financial advice.

3. Financial Planning and Analysis (FP&A)

Advisory teams help create forecasts, interpret trends, and plan for different business scenarios. This adds confidence to decisions about expansion, hiring, or cost control.

4. Financial Close and Reporting

Accurate and timely reports are key to business oversight. Advisory experts help streamline the close process and ensure leadership has the data needed to respond quickly.

5. Technology and Automation Support

New platforms can automate repetitive tasks, but choosing the right tools and integrating them into daily operations takes expertise. That’s where advisors come in. Advisory professionals help streamline this process while keeping it compliant and transparent.

Why Accounting Advisory Matters Now More Than Ever

Business owners and finance leaders are recognizing that accurate data alone isn’t enough. They want to know what the data means and what to do with it. Advisory services provide that missing link.

Here are three reasons this shift is accelerating:

- Greater complexity. As companies grow, their financial systems become harder to manage without guidance.

- More tools. With cloud platforms, AI, and new tech, businesses need help choosing the right systems and integrating them into operations.

- More strategic decisions. Leaders are expected to make faster decisions with higher stakes. Advisory accounting provides clarity in these moments.

Who Should Consider Advisory in Accounting?

While any business can benefit, advisory is especially useful for:

- Mid-sized firms planning expansion

- Companies looking to restructure or scale

- Startups without internal finance leadership

- Organizations preparing for acquisition or funding

The common thread is a need for financial guidance that is relevant, practical, and forward-looking.

How Wiss Helps Clients Put Strategy Into Practice

Wiss delivers advisory services that are tailored, not templated. The team learns the business, understands the goals, and offers real-world recommendations based on numbers and industry experience.

From managing day-to-day financial operations to advising on long-term planning, Wiss positions itself as a partner in the process. That partnership is grounded in communication, transparency, and results.

You can see this approach in action through Wiss’ accounting advisory services, which combine tactical execution with strategic guidance.

What Is Accounting Advisory in Summary?

To put it simply:

- Advisory in accounting is about using financial expertise to help businesses make smarter decisions.

- It focuses on the future, not just the past.

- It supports strategy, growth, and operational improvements.

- It works best when it’s built into ongoing business conversations, not kept separate.

This is not a luxury service. For many companies, it’s the new standard for what they expect from a financial partner.

Talk to Wiss About What Comes Next

Wiss offers more than accounting. We deliver strategic financial leadership designed for the realities of modern business. If you’re reevaluating your finance function, exploring expansion, or simply want a clearer view of your numbers, a conversation with Wiss is a smart place to start.

Reach out here to schedule a discussion with our team. Let’s talk about what you want to build, and how we can help you get there.

Previous

Previous