Donald Trump’s “One Big Beautiful Bill Act” (OBBBA) made the Qualified Small Business Stock (QSBS) regime both broader and faster for new issuances—inviting a fresh look at entity choice, equity design, trust planning, and exit timing.

The Federal Pivot Under OBBBA

New QSBS for stock acquired after July 4, 2025.

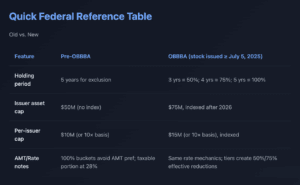

What changed vs. prior law (headline items):

Holding period relief

New tiered exclusion for newly issued QSBS—50% after 3 years, 75% after 4 years, 100% after 5 years. Pre-OBBBA, you generally needed 5 years to get any exclusion. (Old stock keeps old rules.)

Bigger companies can qualify

The issuer asset cap rises from $50M → $75M (at issuance), indexed for inflation after 2026.

Bigger personal cap

The per-issuer cap increases from $10M → $15M (MFS: $7.5M), also inflation-indexed going forward. (10×-basis alternative remains.)

Rate mechanics unchanged

Any non-excluded QSBS gain is still taxed at the 28% collectibles rate (plus NIIT as applicable). AMT treatment continues to avoid a preference item when you’re in the 100% bucket.

Key Implication

For post-OBBBA stock, exits no longer face a “cliff.” A 3–4 year IPO/M&A path can still deliver meaningful exclusion while keeping the 5-year target in sight. Existing QSBS (pre-7/4/2025) still follows the prior five-year/legacy caps framework.

State Treatment—Why Location Still Matters

Especially for tech hubs.

New Jersey (big change)

NJ now conforms to §1202 for tax years beginning on or after January 1, 2026. That means qualifying QSBS gain excluded federally will be excluded for NJ GIT starting in 2026.

New York

NY generally conforms to federal treatment; NY residents can reflect the federal QSBS exclusion in computing NYS and NYC personal income tax. (NYC’s system conforms via NY AGI starting point; watch trust-situs nuances.)

Massachusetts

MA now fully conforms—for tax years beginning January 1, 2022, qualifying QSBS gain excluded federally is also excluded for Massachusetts personal income tax. A 3% preferential rate remains for certain non-federally qualifying stock.

Washington

Despite no income tax, WA’s capital gains excise tax excludes QSBS to the extent excluded federally (so OBBBA benefits flow through).

California

No conformity—QSBS gains are generally fully taxable for CA PIT and worth noting is CA’s historically aggressive residency sourcing rules for founders who move pre-exit.

Additional QSBS-Friendly Tech Centers

Beyond the original list, several other vibrant tech hubs also fully conform to IRC § 1202—namely Arizona, Colorado, Connecticut, Delaware, Georgia, Texas, Utah, Virginia, and Wisconsin. This uniform state-level conformity further amplifies QSBS planning benefits across ecosystems like Silicon Slopes, the DMV corridor, Atlanta’s fintech boom, and Phoenix’s semiconductor cluster. Tennessee, Florida, Nevada, Wyoming, South Dakota and Alaska, while not conforming states, are equally favorable due to the absence of state-level capital gains tax.

New Jersey Spotlight

NJ’s 2026 conformity is retro-relevant for holders who hit the five-year mark in or after 2026—worth modeling now for expected exits.

Planning Opportunities to (Re)Model Now

Below are practical levers—especially relevant for founders, early employees, angels, and family offices in tech ecosystems.

Stacking (multiplying caps across taxpayers)

Gifting QSBS to family members and/or properly structured non-grantor trusts can create additional per-issuer exclusions (e.g., $15M each under post-OBBBA). Risks: assignment-of-income/step-transaction if gifts occur too close to a “practically certain” sale; state anti-ING rules (e.g., NY) can collapse non-grantor treatment.

Action: plan gifts well before LOIs; document business purpose; evaluate trust situs.

Packing (optimizing the 10× basis alternative)

Capital contributions and other basis-building moves can expand the 10× basis limit (still available alongside the $15M cap). Coordinate high-basis and low-basis dispositions within a year to maximize the exclusion math; avoid tripping §1202 anti-churning and redemption rules.

Trust situs & state mitigation

Even if your state doesn’t recognize QSBS (e.g., CA), careful pre-sale planning may reduce state tax: consider non-grantor trusts sitused in states with favorable rules, and/or residency planning well ahead of a binding sale. Additional benefits: such trusts can also provide asset protection against creditors and Valuation & Forensics, and meaningful estate tax savings when combined with lifetime exemption strategies.

Caution: NY in particular treats ING trusts unfavorably; substance, administration, and timing are scrutinized.

Exit timing under the new tiers

For new QSBS (issued ≥ July 5, 2025), aligning liquidity windows to 3/4/5 years can materially change proceeds after tax; build board-level “go/no-go” gates around these dates. (Old QSBS keeps the 5-year rule.)

Mind the redemption traps

Section 1202(c)(3) anti-churning can strip QSBS status if there are related-party or significant redemptions within specified two- and four-year windows around issuances.

Action: diligence cap tables and repurchase histories before relying on QSBS.

Keep §1045 in your toolkit

The 60-day rollover can still defer gain on QSBS held ≥ 6 months when a sale happens before you hit the target holding period—positioning you to re-qualify later. (OBBBA didn’t repeal §1045; confirm nuances if you seek to “upgrade” old stock into post-OBBBA benefits.)

Practical scenarios we’re seeing

Pre-OBBBA holders in NJ

If your five-year date lands in 2026, the federal exclusion already applied—now NJ lines up, too. Model the state delta on tender/secondary vs. deferring to five years.

Tech exits at 3–4 years (post-OBBBA stock)

Partial exclusions at 50%/75% may change deal math on earlier M&A vs. waiting to year 5; layer in WA treatment (if applicable) and CA nonconformity for distributed teams.

Founders in CA contemplating relocation

Pre-sale, fact-pattern-driven relocation can eliminate CA tax on intangible gain; timing and continuing ties are critical. Pair with trust situs analysis (INGs won’t solve it alone in NY; CA has its own look-throughs).

Bottom Line

OBBBA reshapes the QSBS calculus for new stock—introducing partial exclusions that reward earlier exits and lifting caps to better match modern venture scale. Meanwhile, New Jersey’s 2026 conformity removes a persistent state-tax drag for local residents, while California’s nonconformity continues to demand separate planning. For owners and boards, the question is no longer just “Do we have QSBS?”—it’s “Are we harvesting it fully across taxpayers, trusts, states, and time?”

Tight Action List for Deal Teams

- Map who actually holds the stock (individuals, funds, grantor/non-grantor trusts)—and their states.

- Re-paper equity programs to avoid §1202 anti-churning pitfalls (redemptions/repurchases windows).

- Build a 3/4/5-year exit calendar for post-OBBBA issuances; stage-gate board materials accordingly.

- Pre-LOI: evaluate stacking (done early) and packing (basis strategy) opportunities.

- For CA/MA/NY/NJ/WA/TX footprints, produce a one-page state matrix for CFO sign-off before signing a term sheet.

Maximize Your QSBS Benefits with Expert Guidance

OBBBA has fundamentally reshaped the QSBS landscape, offering founders, investors, and deal teams new opportunities to optimize tax benefits and exit strategies. From faster exclusions to higher caps, these changes demand a fresh look at your planning approach. Whether you’re navigating entity choice, equity design, or state-specific tax implications, proactive planning is key to maximizing these benefits.

Ready to make the most of the new QSBS rules? Contact us today to explore tailored strategies that align with your goals and ensure you’re fully leveraging OBBBA’s advantages.

Previous

Previous