Staying pragmatic in a world of hysteria and anecdote

As it pertains to the recent bout of tariffs, across many regions outside of China—and potentially Canada—there now seems to be a general sentiment of “let’s make a deal.” Japan and Europe, while maintaining a somewhat firm stance, appear to be actively working to negotiate terms. The UK seems intent on delaying a definitive decision, while countries like Australia and India are also engaging in discussions.

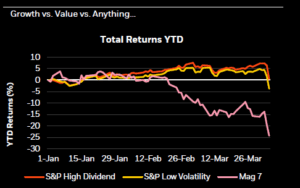

The widespread repricing of risk assets over the past few days has created significant opportunities among stocks that were previously considered the best “value” due to their immense cash flow production. The S&P 500 has declined by 10% over the past few days, and these developments come despite continued strength in U.S. economic fundamentals, as evidenced by Friday’s robust jobs report. While we expect some near-term pull-back in AI investment trends, the longer-term trajectory and need for AI investment is still present according to our institutional partners. While there are jitters that some companies may be walking back data center plans, our partners at BlackRock comment: “the CAPEX and R&D investment cycle can take much longer to play out and one can’t lose sight of this being arguably the most extraordinary technology/productivity/automation revolution of all time.” Amazon is still saying it cannot keep up with AI demand. The demand for data centers has skyrocketed in recent years, with an incredible number under construction across the US. Nevertheless, with an average construction of 3-6 years, these investments take considerable time and investment. We remain largely opportunistic on tech sector over the long term. Should margins become more compressed, our institutional partners believe companies will use more automation, software, and robotics, while demand for AI will continue to be high.

Source: BBG, as of 04/04/2025

GDP and Earnings

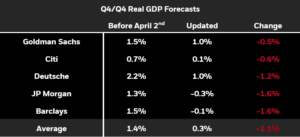

Economists have recently revised their GDP numbers for the end of the year (see below chart). With the US being a largely domestic, service-oriented economy, our institutional partners believe marginal tariffs will be disruptive in the short term, but the impact will be contained if the recently announced sizes are scaled back (this is assuming a longer-term baseline of 15% average tariffs). On Friday, the banks will kick off earnings season for us. PE multiples for large cap stocks have come down from 22 times earnings to 18 times earnings. PE ratios have tended to overcorrect preceding earnings that come in lower than expected. We will be watching closely.

Source: BBG Goldman Sachs, Citi, Deutsche Bank and Barclays, as of 04/04/2025

Employment Reports, Cross-Border Business Developments, and Consumer Sentiment Closely Watched

With interest rates at their current levels, the Fed retains the flexibility to adjust policy as needed. Currently, the Fed lacks sufficient data to make definitive decisions so we anticipate that the Fed will closely monitor employment trends over the next two months. Job growth in the past few years has been significantly driven by healthcare, education, and immigration, which have expanded the labor pool, enabling entities to operate at or near full capacity. Cuts to Medicaid would force states to downsize the program, pushing costs to healthcare providers. Notably, 44% (3.1 million) of the 7 million private payroll gains over the past three years originated from the Education and Health Services sector. Immigration has been a strong boost to labor supply in recent years as well. Estimates suggest immigrants might have accounted for a majority of the private payroll gains over the last two years; yet, this looks set to slow substantially going forward, which is also likely to reduce job gains. These employment dynamics are hugely important for near to intermediate-term labor reports, potentially providing the labor weakening in other sectors that the Fed needs to begin cutting interest rates. Also, noteworthy – higher interest rates have exacerbated the housing affordability crisis, particularly affecting the lower 50% of income earners. This issue is a focal point for the Administration, which could benefit from lower rates and potential fiscal incentives. Finally, the focus on lower rates is understandable in the context of the compounding and ballooning US debt, and high interest payments around this debt. Nevertheless, inflation remains persistently high at 3.5% annualized (core 3month and 6month CPI), posing a challenge for the Fed amid slower growth prospects.

Cross-border businesses, M&A activities, and the information companies share will be indicators for investors of how things will play out. These factors reveal how businesses are adapting and strategizing. Economic data, such as payroll figures, tend to be backward-looking, so will be of less value to investors in the current climate. Meanwhile, consumer sentiment and spending also remain crucial focal points, keeping in mind sentiment surveys can be highly volatile, changing rapidly within a day or even an hour, and often influenced by knee-jerk reactions.

Building High Quality, Diversified Portfolios: Wealth Creation Starts Subsequent to 10% Drawdowns

Our partners at JP Morgan Asset Management have observed significant outflows from active equities into passive equities over the past few days. This trend underscores the importance for investors to feel confident that they own the right stocks and maintain balanced exposure to both growth and value sectors.

We continue to favor diversified portfolios that optimize return, tax alpha, and high-quality fixed income. Our approach focuses on building robust portfolios with reduced volatility, not playing headline roulette, and managing risk thoughtfully. We are proceeding cautiously when putting cash to work on the fixed income side, locking in attractive rates, particularly in the front end and belly of the yield curve which has presented us with opportunity. While we remain cautious on broad equity benchmarks, current market dislocations are creating attractive opportunities for selective investments. Our institutional partners agree that structural themes, such as the advancement of artificial intelligence, will continue to drive returns. Additionally, U.S. policy developments are prompting increased fiscal spending globally.

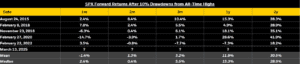

It can take some time to play out, but the forward condition from these types of drawdown historically is pretty clear (see below chart). The question is when the clock starts on the upswing.

Source: BlackRock. Change, page 20.

We thank you for your trust in us. We will continue to keep you informed as we monitor things closely.

Previous

Previous